The Economics of Discontent

University of Michigan Professor of Economics Justin Wolfers proclaimed in an April 2, 2024, New York Times article, “Our economy is larger, more productive, and will yield higher average incomes than in any prior year on record in American history.”1. He added that since the United States is the world's wealthiest major economy, we are undoubtedly part of human history's most affluent society.2 However, as a measure of Americans' economic optimism, the University of Michigan consumer sentiment index remains 20% lower than the robust economy of 2020.3

A group of economists led by the former US Treasury Secretary and World Bank Chief Economist Larry Summers noticed that traditional gauges of consumer optimism, such as unemployment and inflation, were low and falling. Still, consumer pessimism persisted, departing from decade-old norms.4 In the 1970s, economist Arthur Okun combined the unemployment rate and inflation rate (CPI) to form the Economic Discomfort Index, a devilishly simple way to gauge the economy's vibrance and, potentially, consumer sentiment. Ever the grand narrator to the masses, Ronald Reagan, rebranded Okun’s measure as the Misery Index (Chart #1).5

Nobel laureate economist Paul Krugman proffered that since 1948, the Misery Index has performed “far better” than expected despite its crude construction.6 When paired with the University of Michigan’s Consumer Sentiment Index (Chart #2), Okun’s index shines. The high negative correlation between the two indexes is easy to detect with the naked eye. The Misery Index’s troughs mark Michigan’s consumer sentiment highs and vice versa, suggesting a high level of comovement between Okun’s index and consumer attitudes. While the Misery Index looks rosy, the University of Michigan's Consumer Sentiment is not celebrating, as it remains below its pre-pandemic levels.

“The economy is booming, and everyone knows it - except for the American people,” Summers and his colleagues wrote in February 2024.7 What are the sources of the disconnect between Okun’s Misery Index and the Michigan Consumer Sentiment Index? More concisely, what are the economics of American discontent?

The Conundrum

The quote “attitude is a little thing that makes a big difference” has always intrigued me for its subtle veracity. For many decades, politicians, public relations mavens, marketing gurus, and social psychologists have attempted to influence people’s attitudes for their difference-making effect on behaviors.8 Similarly, social scientists have labored to measure and index attitudes under the banner of sentiment to find causal links to affect future actions. The challenge is that sentiment is an attitude, thought, or judgment prompted by feeling, and those feelings are often cultural constructs and very context-dependent, subject to the vicissitudes of time.9

Research suggests that attitudes influence future behaviors when they are easily retrieved from memory or “top-of-mind” and stable over time. However, sentiment sources can shift in uncertain ways over decades, confounding measurement. Arthur Okun’s Misery Index combines long-collected measures of inflation in the Consumer Price Index (CPI) and the unemployment rate to index consumers’ economic well-being. These figures are often media-quoted, top-of-mind numbers that frequently sway consumers' thoughts, reflecting the cost of living and job security.

The disconnect between the Misery Index and Michigan's Consumer Sentiment poses a perplexing puzzle for economists well-versed in the literature confirming the high correlation between inflation, unemployment, and consumer sentiment.10 Several explanations have emerged to make sense of this new trend, including the delayed impacts of the sticker shock of inflation, speculations about partisan media, and intangible "vibes" shaping the disparity. Many of these ideas have fused into a "referred pain" thesis, suggesting that factors beyond economics are now swaying consumer sentiments.11

Not to discount any competing theories, it seems more intuitive to crack open the Misery Index’s labor component for answers to the current separation anxiety. The employment rate is the flip side of the unemployment rate. Peaking inside the employment data quickly reveals the notion of underemployment. A complex construct operationalized and measured in various ways, the term underemployment generally attempts to capture a worker overqualified for a position.

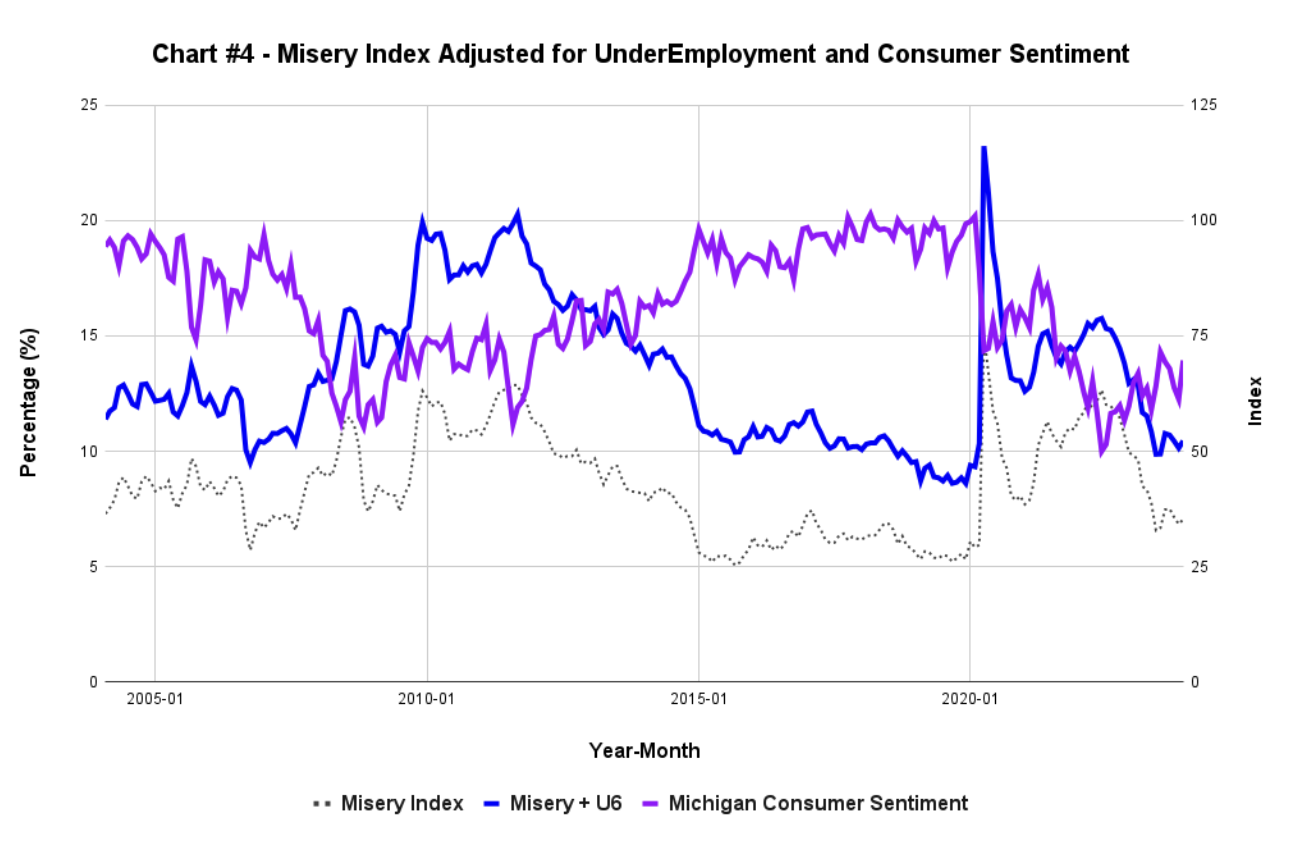

The US Bureau of Labor Statistics’s U6 data (Chart #3) track “persons marginally attached to the labor force, plus total employed part-time for economic reasons.”12 Underemployment (U6) adds to and positively tracks the unemployment rate (U3). Adjusting the Misery Index for underemployment with the BLS U6 (Chart #4) is fruitless due to the correlation between U3 and U6, failing to lend insight into the economics of American discontent.

Underemployment for College Graduates

Unfortunately, the BLS Underemployment U6 broad measure failed to illuminate the sentiment disconnect; however, the New York Federal Reserve Bank’s research into the labor market for recent college graduates offers a different perspective. The share of underemployed graduates in jobs that typically do not require a college degree is not a new issue for the NY Fed’s economists.13 The Reserve Bank has been measuring wages (Chart #5) and underemployment (Chart #6) for college graduates since 1989.14

The rate of underemployment among recent college grads is relatively high and cyclical. Despite the slow start for recent college graduates, wages (in 2023 dollars) are at highs for the last four decades, widening the gap between high school graduates. As a group, the percentage of college grads overqualified for a position has remained relatively stable for the last three-plus decades at one in three. Both New York Fed measures reinforce the notion of a robust and thriving US economy.15 However, a source of discontent does emerge after drilling down deeper into one demographic segment of the college grads.

The Under-30 Crowd

A December 2023 poll by The New York Times and Siena College pinpointed one segment of the American voter population as a glaring source of the sentiment mismatch in the economics of American discontent. The survey found that only 2% under 30 rated the economy as “excellent,” and 59% answered “poor.”16 The polling results are jaw-dropping, given that traditional economic measures indicate America’s thriving and robust economy. The under-30 crowd is unique in several ways, but two stand out. Since they began adulting, the under-30 crowd has produced a record crop of college graduates, now 37% of the total US population, up from 30% more than a decade earlier.17 Those new graduates came at a steep cost. Over the same period, student loan debt grew from $800 billion to over $1.7 trillion (Chart #7).18

The wave of new graduates was absorbed into the labor market without depressing wages or pushing up graduate underemployment as a percentage. Unfortunately, a sub-rosa economic lament remains as the Burning Glass Institute, and Strada Education Foundation contend that underemployment for graduates is persistent or sticky. Fifty-two percent of graduates with a terminal bachelor's degree are underemployed one year after completion, a total higher than the New York Fed’s one-third.19 After ten years, 45% of those graduates remain underemployed. Their research suggests that most graduates who start in college-level jobs stay in them, while underemployed graduates largely remain underemployed.20

Adding to the troubling underemployment in the under-30 crowd is that student loan debt has become a more burdensome reality. Morning Consult polling for the National Association of Realtors sought to uncover the impact of student loans on graduates as consumers. Twenty-nine percent indicate their debt has affected their ability to purchase a home, 35% to take a vacation, or 31% to buy a car.21 As of the end of 2023, forty-four million U.S. borrowers owe more than $1.6 trillion in federal student loans, with private loans pushing the total to above $1.7 trillion.

Most experts and policy-makers agree that surging college debt slows generations of students from achieving their financial goals. Older generations were generally able to find jobs to pay their way through school. Not so for this generation of scholars. In 2010, total student loans exceeded auto loans and credit card debt, with only the $12 trillion of home mortgage loans being of a more significant consequence to American society.22

Given the polling data on deferred or delayed spending, college debt’s impact on consumer spending is unquestionably moving the needle in Michigan’s Consumer Sentiment Index. Consumers restrained by the considerable growth in their college debt and sticky underemployment represent a piece of the puzzle in sourcing the economics of American discontent. The lasting economic harm of college debt and underemployment explains why the Biden Administration is laser-focused on student loan relief programs.

Final Thoughts on the Economics of American Discontent

With 37% of Americans possessing a college degree, their underemployment casts a long sentiment shadow over the quality, not the quantity of employment, in the Misery Index. Okun’s measure fails to contextualize the prevailing employment zeitgeist. A well-educated, underemployed, and student loan-burdened labor force was probably beyond Arthur Okun’s thinking decades ago. By contrast, Michigan’s Consumer Sentiment Index is better crafted to register the economic angst of the under-30 college grads, resulting in a disconnect from prior comovements with the Misery Index.

What are the economics of American discontent? Despite a vibrant economy, a significant portion of America’s best and brightest, the college-educated, remain cheerless, bridled by underemployment and high student loan debt. Recent inflationary pressures are likely the straw that broke the camel’s back on this demographic. The full extent of those factors' impact on economic optimism requires more research and effort to identify the other potential variables, like inflation’s price sticker shock, that are at work to depress consumer sentiment. Also, reflecting on Chart #7, underemployment and excessive student debt might impact college graduates beyond the under-30 demographic.

Finally, President Biden’s preoccupation with student debt relief lends creditability to the contention that educational loans are a piece of the economics of American discontent puzzle beyond the sticky college graduate underemployment. Seeking credit for a robust economy and coveting votes for a fast-approaching election, President Biden remains supremely motivated to grant relief from the enormous student debt burden as a potential path out of sentiment purgatory. First-term Presidents who engineer economic prosperity typically get a second term. For many college graduates, underemployment and high student loan debt tug at their economic optimism and move the American dream over the horizon. In a final push to deliver on his college loan relief pledge, President Biden pressed his chief of staff, Jeff Zients, in late March “to make sure his team was making the relief as expansive as possible.”23

Endnotes

1. Justin Wolfers, “I’m an Economist. Don’t Worry. Be Happy.” The New York Times, April 2, 2024, https://www.nytimes.com/2024/04/02/opinion/economy-sentiment-inflation-anxiety.html.

2. Justin Wolfers, “I’m an Economist. Don’t Worry.”

3. Aaron Zitner et al., “Why Americans Are so down on a Strong Economy - ...,” Wall Street Journal, February 7, 2024, https://www.wsj.com/economy/economy-inflation-consumer-spending-unemployment-e6856381.

4. Marijn A. Bolhuis et al., “The Cost of Money Is Part of the Cost of Living: New Evidence on the Consumer Sentiment Anomaly,” NBER, February 26, 2024, https://www.nber.org/papers/w32163.

5. Paul Krugman, “Misery Takes a Holiday,” The New York Times, September 13, 2022, https://www.nytimes.com/ 2022/09/13/opinion/inflation-misery-index-economy-prices.html.

6. Paul Krugman, “Misery Takes a Holiday.”

7. Marijn A. Bolhuis et al., “The Cost of Money.”

8. Glasman, Laura R, and Dolores Albarracín. “Forming attitudes that predict future behavior: a meta-analysis of the attitude-behavior relation.” Psychological Bulletin vol. 132,5 (2006): 778-822. doi:10.1037/0033-2909.132.5.778

9. Merriam-Webster.com Dictionary, s.v. “sentiment,” accessed March 24, 2024, https://www.merriam-webster. com/dictionary/sentiment.

10. Ivan K. Cohen, Fabrizio Ferretti, and Bryan McIntosh, “Decomposing the Misery Index: A Dynamic Approach,” Cogent Economics & Finance 2, no. 1 (December 13, 2014): 991089, https://doi.org/10.1080/23322039. 2014.991089; Heinz Welsch, “Macroeconomics and Life Satisfaction: Revisiting the ‘Misery Index,’” Journal of Applied Economics 10, no. 2 (November 2007): 237–51, https://doi.org/10.1080/15140326.2007.12040489.

11. Marijn A. Bolhuis et al., “The Cost of Money.”

12. “BLS Alternative Measures of Labor Underutilization - 2024 M02 Results,” U.S. Bureau of Labor Statistics, March 8, 2024, https://www.bls.gov/news.release/empsit.t15.htm.

13. Jaison Abel and Richard Deitz, Underemployment in the Early Careers of College Graduates Following the Great Recession, September 2016, https://doi.org/10.3386/w22654 page 149.

14. “The Labor Market for Recent College Graduates,” Federal Reserve Bank of New York - Serving the Second District and the Nation - Federal Reserve Bank of New York, February 22, 2024, https://www.newyorkfed.org/ research/college-labor-market#--:explore:wages.

15. “The Labor Market for Recent College Graduates,” Federal Reserve Bank of New York - Serving the Second District and the Nation - Federal Reserve Bank of New York, February 22, 2024, https://www.newyorkfed.org/ research/college-labor-market#--:explore:wages.

16. Reid J. Epstein, “Times/Siena Poll: Takeaways and Analysis from Our Survey of Battleground States.,” The New York Times, December 6, 2023, https://www.nytimes.com/live/2023/11/06/us/trump-biden-times-siena-poll-updates.

17. US Census Bureau, “CPS Historical Time Series Tables,” Census.gov, February 9, 2023, https://www.census.gov/data/tables/time-series/demo/educational-attainment/cps-historical-time-series.html.

18. Melanie Hanson, “Student Loan Debt Statistics [2024]: Average + Total Debt,” Education Data Initiative, March 3, 2024, https://educationdata.org/student-loan-debt-statistics.

19. Andrew Hanson et al., “Talent Disrupted: College Graduates, Underemployment, and the Way Forward,” The Burning Glass Institute, March 20, 2024, https://www.burningglassinstitute.org/research/underemployment page 6.

20. Andrew Hanson et al., “Talent Disrupted,” page 10.

21. “The Impact of Student Loan Debt - Morning Consult Polling,” www.nar.realtor, June 13, 2021, https://www.nar.realtor/research-and-statistics/research-reports/the-impact-of-student-loan-debt.

22. The CFR Editors, “Is Rising Student Debt Harming the U.S. Economy?,” Council on Foreign Relations, August 22, 2023, https://www.cfr.org/backgrounder/us-student-loan-debt-trends-economic-impact.

23. Astra Taylor and Eleni Schirmer, “The Biden Administration Has a Chance to Deliver Student Debt Relief. It Must Act | Astra Taylor and Eleni Schirmer,” The Guardian, March 5, 2024, https://www.theguardian.com/commentisfree/2024/mar/05/the-biden-administration-has-a-chance-to-deliver-student-debt-relief-it-must-act.